I cover energy, environment, security, & human development.

full bio →

Opinions expressed by Forbes Contributors are their own.

Energy 3,681 views

India Will Be Using and Importing More Coal

Comment Now

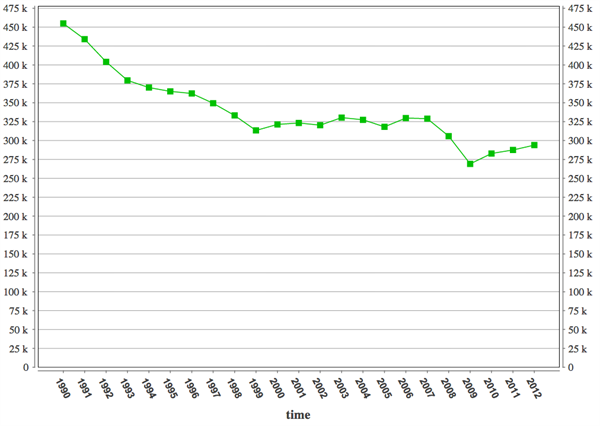

State-owned Coal India Limited

(CIL) is the world’s largest producer (465 million tonnes/year), but

underperformance has the country moving toward imports

and privatization. CIL’s output/employee/year has been around 1,200

tonnes, compared to over 10,000 tonnes in Australia. Capital

expenditures for domestic assets this year were less than $800

million, in contrast to China’s Shenua Group, which spends a few billion

dollars a year increasing coal production. It’s no wonder that India’s

coal supplies and transportation systems are struggling to keep pace

with surging demand, and more foreign coal are needed to fill the

gap. Prime Minister Modi’s “Make in India” campaign will bring

in foreign firms to build factories, expand economic growth, and elevate

India’s living standards, still among the lowest of the emerging

markets. India’s real GDP/capita is just $1,700, versus $4,560 for the rest of the developing world.

Follow Comments

India’s Coal Imports Have Nearly Tripled Since 2008

Source: EIA; Reuters; The Sydney Morning Herald

The Need for Coal-Based Electricity

India is easily the most energy-deprived nation on Earth, with 1) 700 million lacking modern energy services, 2) 310 million lacking electricity, and 3) just a 700 kWh/capita/year electricity use rate (80% below the global average). India’s long-term demand for thermal coal stems from a massive coal-fired build out (Ultra Mega Power Plants, UMPP) that will deploy larger (capacities > 4,000 MW) and much more efficient (> 43% vs. 29% for subcritical) super/ultra-supercritical plants to reduce feed and emissions. Well more than half of new coal-based capacity for the 12th Five Year Plan (2012-2017) will deploy these advanced coal technologies. Cheaper, more reliable baseload coal power will help alleviate widespread electricity shortages that have been eroding the Indian economy by some $65 billion a year! Power Minister Goyal has coal playing an “essential role” in his $250 billion plan to provide “Power for All” by 2019. Per the International Energy Agency (IEA), coal is expected to rise from 43% of total energy supply today to 46% in 2020 and 51% in 2035, while maintaining its ~68% hold on electricity.

Importantly, India has watched neighbor China leverage coal power to lift 650 million people out of poverty since 1990, and sail past the global average for Human Development Index. Over that time, China’s per capita coal electricity use rate increased to 3,200 kWh, up from just 420 kWh in 1990. Wanting the same, India’s coal demand structure has evolved from 54% power generation in 1990 to 68% today, against 85% in the EU and 93% in the U.S. Since 2000, India’s coal power has nearly doubled to 800 TWh, while real GDP/capita doubled and Health Adjusted Life Expectancy increased 5 years to 58. India’s new modern coal plants are reducing SO2, NOx, and particulates and slash CO2 emissions by nearly 40%. And despite staggering energy poverty, India has impressively lowered its carbon intensity (on a PPP level) by ~17% since 2006 (when UMPP started), on par with EU progress. Indeed, environmental groups MUST realize that even under the IEA’s highly optimistic best-case policy projection for renewables (450 Scenario), wind and solar together will be just 8% of India’s electricity in 2020 and 17% in 2035. And even then, 20 years from now, Indians at most are expected to consume just 20% of WHAT AMERICANS CONSUME TODAY. Note: refrigerators are among the biggest consumers of electricity in homes, generally using more than the average Indian uses in total.

The Incredible Scale of Latent Demand for Coal-Based Electricity in India

Source: IEA

Source: IEAIndia’s Coal Generation Capacity Will Nearly Quadruple (2011-2035)

Source: IEA, WEO 2013; Mining Weekly

Source: IEA, WEO 2013; Mining WeeklyThe Need for More Coal to Make Steel

Met (metallurgical) coal is used to produce coke which is critical in steelmaking. Indian steelmakers used ~40 million tonnes of met coal last year, and imports could more than triple to 110 million tonnes by 2025, while steel capacity also triples to 300 million tonnes. India’s needs for more met coal and steel arise from a rapid urbanization process that has population centers swelling by nearly 15 million people annually. India is still just 32% urbanized, compared to 52% in China and 82% in the U.S. Thus, India’s per capita steel use is still very low at 57 kg/year, versus 310 kg in the U.S. and 480 kg in China. Steel and Mines Minister Tomar wants to roll back the 2.5% customs duty on met coal to help the domestic steel industry. Global overcapacity has met coal markets at the bottom of the cycle, and the inevitable recovery is emerging (see here and here). Coal market watchers remember: 1) cities are built on electricity, steel, and cement (coal is the basis of all three) and 2) global cities are expanding by ~75 million people a year.

Coal Imports Will Continue to Boom

The IEA projects that India will be the world’s largest coal importer by 2020. India’s large reserves (5th globally at 61 million tonnes) should be tempered by a few factors:

- India needs more capital intensive underground mining, which has stagnated from an over-focus on cheaper opencast mining. Underground mines account for 60% of CIL’s mines, but they only account for ~10% of the company’s total production, versus 95% in China, 40% in the U.S., and 28% in Australia.

- Technical and institutional problems have restricted the mechanized longwall technology used to minimize underground mining losses. India’s underground output requires a quantum jump from 0.50 to 2.7 tonnes per man year.

- The true size of India’s coal endowment isn’t known. Natural resources in the country are often assessed geologically, not the more appropriate techno-economically. Technical energy terms like “resources” and “reserves” have been misused in Indian appraisals.

- The quality of Indian coals is lower, especially high ash and low calorific values. Indian coal does have low sulfur content, but this leads to less boiler efficiency, meaning more coal input per output unit.

- India’s own met coal supply has been falling, and domestic reserves constitute just 13% of the country’s total. Many are inaccessible because they sit under communities or land reserved for farming.

India’s Coal Imports Will Continue to Boom

Source: IEA, WEO 2013 (current policies)

Source: IEA, WEO 2013 (current policies)Source: Forbes

Blog

The future of coal in China, India, Australia, the US, EU, and UK

Have reports of coal's demise been greatly

exaggerated? It depends which part of the world you look

at.

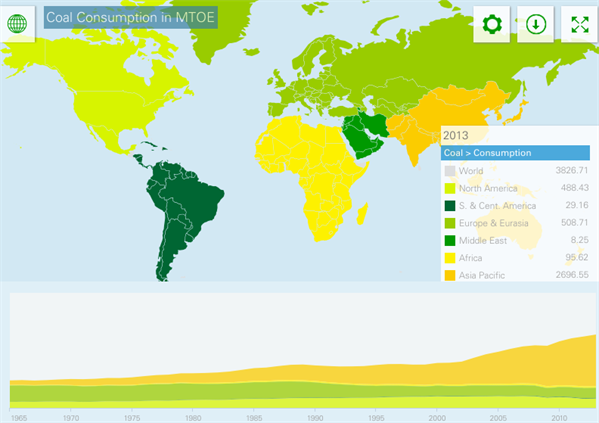

Global coal use has grown significantly over the last decade,

with global demand increasing 60 per cent between 1990 and 2011,

according to research body the International Energy Agency (IEA).

With some countries implementing climate policies to limit the use

of polluting fuels, some commentators are predicting

coal's imminent demise.

Source: BP Statistical Review of World Energy

That's probably premature. While some European countries are ramping up renewables, shutting coal plants and closing mines, other parts of the world are planning an extraction frenzy to feed emerging economies' seemingly insatiable energy demand.

Here's a quick guide to coal's prospects around the world.

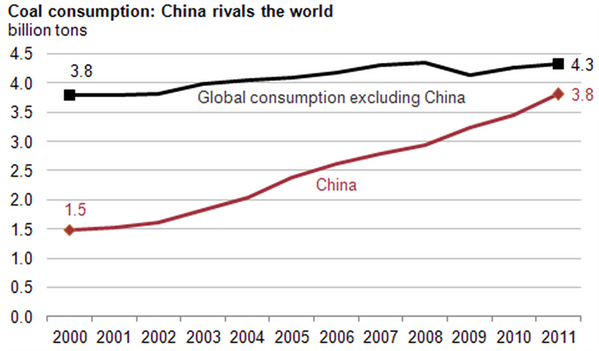

China: Coal is dominating the market

China is the world's largest coal user, producer and importer. Motivated by air quality concers, China is making some efforts to reduce use of coal power, but the country still uses a huge amount of coal - 4.2 billion tonnes in 2012, according to the Energy Information Administration.

That's about four times as much as the whole of

Europe consumed the same year.

Source: US Energy Information Administration

Last September, the government prohibited the building of new coal power plants in three populated areas around Beijing, Shanghai, and Guangzhou as part of the country's national action plan. That should help curb coal power generation. But the World Resources Institute, an environmental thinktank, says further national policies will be needed if the country is to make significant steps to reduce power sector emissions.

Credit: ZHart

The IEA expects China to continue to be a major industrial coal consumer. Aside from the power sector, the iron, steel and cement industries all rely on the fuel for heat and power. As such, coal is set to continue as China's main energy source all the way up to 2035, and possibly beyond, according to the IEA. And China will continue to ramp up coal production to meet demand, the IEA says.

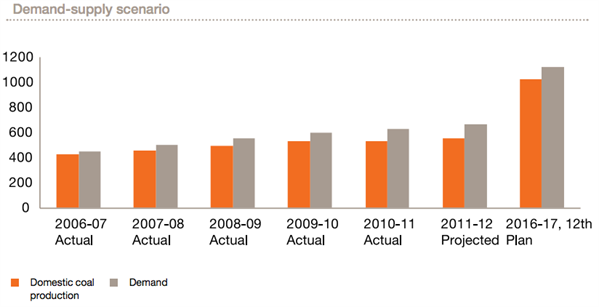

India: Coal boom

India is currently the world's third largest coal consumer, and demand for the fuel is set to grow in coming decades. PwC, a consultancy, projects India's coal demand will grow by about seven per cent each year for the next decade. The IEA expects India to more than double its coal consumption by 2035.

Commercial, technical and legal difficulties - alongside a series of major political scandals - have held up the expansion of India's mining industry. That means that while India produces a lot of coal, it's unlikely to be able to increase production quickly enough to meet rocketing demand - creating an ever-largening gap between production and demand, as this chart shows:

Source: PwC, The Indian coal sector: Challenges and future outlook

That means India is likely to become increasingly

depend on imports, and is set to become the world's largest coal

importer by around 2020, according to the IEA.

Australia: Relying on exportsWhile some have argued that a solar power boom means the Australian coal industry is no longer economically viable, the country remains the world's second-largest coal exporter.

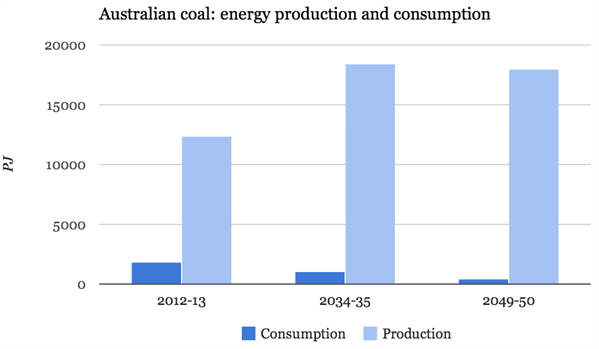

While domestic consumption is expected to reduce in coming years, the Australian Bureau of Resources and Energy Economics (BREE), an Australian government economic research unit, still thinks coal has a future.

Credit: Calistemon

Electricity consumption from coal is expected to get squeezed in the coming decades as renewable energy - particularly small scale solar - starts to become more competitive, the BREE predicts. Likewise, domestic energy consumption from coal is expected to tail off (the dark blue bars on the chart below).

Source: Australian Bureau of Resources and Energy Economics data. Graph by Carbon Brief.

In contrast, BREE expects coal production (the light blue bars on the chart above) to increase up to 2035, before falling slightly.

BREE predicts that coal production will be at a higher level in 2050 than it was in 2013, with most of the coal likely to be exported to Asia's emerging economies, as China's demand drops.

USA: Coal going strong despite shale gas

The US uses the most coal of any developed economy, according to the IEA - with the country accounting for 45 per cent of the OECD's total coal consumption.

Credit: Doc Searle

Coal is primarily used for power generation. Despite the country's well publicised shale gas boom, coal remains the main fuel used for electricity generation, generating about 40 per cent of the US's power in 2013, with gas producing about 29 per cent, according to the Energy Information Administration (EIA), the energy statistics department of the US government.

The EIA doesn't expect this to change much in the next two decades. It projects coal providing about 40 per cent of the US's power in 2035, despite the President's much lauded plans to curb coal power generation.

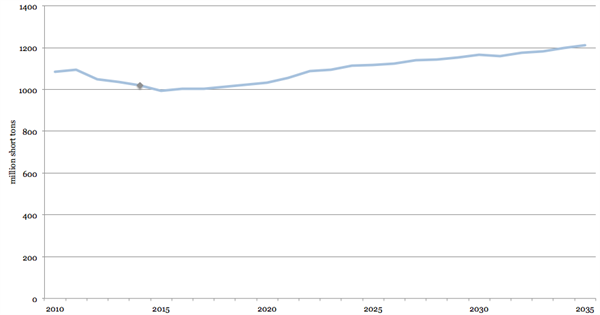

Similarly, the US is likely to keep producing a lot of coal. The EIA expects coal production to increase gradually to 2035, with most of the fuel exported.

Source: US Energy Information Administration. Graph by Carbon Brief.

EU: Long term squeeze

It's a very different picture on the other side of the Atlantic, where the EU's long term commitment to addressing climate change should see coal increasingly squeezed out of the energy mix.

The European Commission expects energy consumption from coal to halve by 2050, from 16 per cent to 8 per cent. As renewables increase their share of electricity generation, much less coal is expected to be used to fuel the region's power stations. The commission projects coal generation will account for 12 per cent of the EU's electricity in 2030, and 7 per cent in 2050 - down from 24 per cent in 2010.

Although the EU's coal consumption has dropped significantly over the last two decades, there has been a slight uptick in recent years, as the graph below shows. That's partly down to countries using cheap coal imports for power generation instead of less-polluting gas, in part as a consequence of the US shale gas boom.

Source: Eurostats, Inland energy consumption by fuel: solid fuels, by 1,000 tonnes of oil equivalent

In the long term, the downward trend in coal use is likely to resume. Policies such as the large combustion plant directive and industrial emissions directive which limit air pollution are expected to force many coal plants to reduce the amount they operate, and eventually shut.

Officials hope the EU's energy efficiency policies and renewable energy goals will also see the region use less energy and switch to less polluting power sources.

UK: A coal minnow

The EU trends are expected to be reflected in the UK.

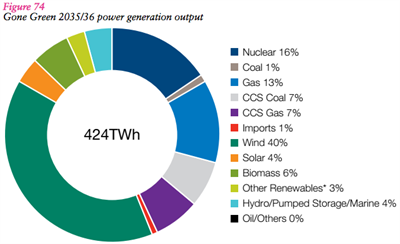

A new report from the network operator National Grid looks at four ways the government could decarbonise the UK's energy sector. Unsurprisingly, coal has a limited role in each of them.

The scenarions show coal's share of the UK's power generation falling to between one and nine per cent by 2035, down from around 40 per cent today.

Gas could be expected to take over as the primary fossil fuel used to generate electricity, with perhaps as much as 47 per cent of our electricity coming from gas in 2035, National Grid suggests.

Source: National Grid, 'Going Green' scenario in the Future Energy Scenarios 2014

Coal and the UK's climate legislation are basically incompatible, barring large-scale carbon capture and storage. The UK has a legally binding commitment to reduce emissions by 80 per cent by 2050. As the power sector currently accounts for about 30 per cent of the country's emissions, a lot of the cuts will have to be made by switching to cleaner sources, like nuclear or renewables. EU legislation also requires the UK to ramp up renewables and phase out old coal power plants.

But as the data we've just discussed suggests, without international efforts to decarbonise, it's likely the coal that the UK or Europe would have used will still get burned somewhere. Coal's global future ultimately depends on whether policymakers implement stringent climate policy.

In summary, a range of projections suggest coal is not dead and is probably not going to die any time soon. For now, assessments of the coal industry's health rather depend on which part of the world is under the microscope.

the climate brief

Licensed under a creative commons license

Published by Climate Brief Ltd - Company No. 07222041

Peak (thermal) coal ?

December 10th, 2012

Most of the news on CO2 emissions has been bad. In particular,

there are plenty of stories suggesting that coal-fired electricity is

booming, and that this can be expected to continue. Although the

evidence is mixed, I’m coming to the opposite conclusion. It’s already

clear that no new coal-fired power stations will be constructed in the

US for some time to come, and that many old ones will close, thanks to

cheap gas and EPA regulations. And, while there are some new stations

coming on-line in the EU, closures will predominate there too, although

they still need to work out what to do with Poland.But the big news is from China. Not that long ago, the standard story was that China was turning on two new coal-fired power stations every week. Now as this AFR report (paywalled, but another version here) says, China is cutting back hard on coal expansion. I found this story from March, in which the China Electricity Council says that it expects coal consumption in 2015 to be below the 2011 level, implying that the peak is very near. India is also planning some big expansions, but if China can grow without coal, so can they.

All of this suggests that the peak in global use of thermal coal could be much closer than is generally thought. Demand for metallurgical coal, used to produce steel, seems much more robust at least as long as investment-driven growth continues apace in China and India. Looking at the other fossil fuels, we reached plateau oil at least five years ago. On the other hand, gas (less carbon-intensive than the others, but still a source of CO2) is booming. So, there’s still a lot of work to be done before we can end the growth in emissions, let alone start on the 80 per cent reductions we need.

Introduction

Coal is the main commercial energy fuel in India, amounting to 55% of installed electrical capacity in 2011[1]Ambitious plans by the Indian government to extend the electrification rate from its 2005 level of approximately 44% to the whole population, as well as catering for rapid growth in industrial and household consumption, are driving plans for a massive expansion of installed electricity capacity.India has "proved" coal reserves estimated by the Ministry of Coal at 93 billion tonnes and are estimated to be sufficient for 30 to 60 years; however Indian coal is of low quality as it has a high ash content.[2] In August 2010, the EIA projected that India has coal reserves of 62,300 million short tons.[3]

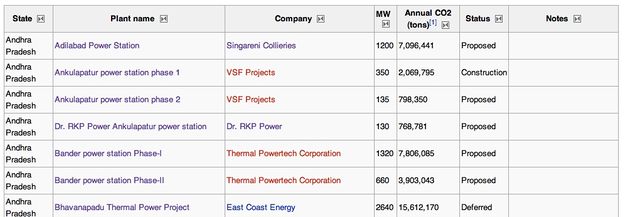

2007-2012: The Rush to Build Coal Plants

For more details, see Proposed coal plants in India and Existing coal plants in India2007-2011: The rush begins

As shown in Table 1 below, India's coal plant capacity was relatively stagnant through the end of the 10th Plan on March 31, 2007. Since then, growth has been rapid, including a 79% increase in capacity from March 31, 2007 through May 31, 2012 (mostly since the beginning of 2010) and an additional 76% increase represented by projects currently under construction. [4][5]Table 1: Coal plant capacity additions since 1985, and current capacity under construction

| Date | Capacity (MW) | Growth (MW) | Growth rate | Period |

| 31-Mar-85 | 26,311 | |||

| 31-Mar-92 | 44,791 | 18,480 | 70% | (7 years) |

| 31-Mar-97 | 54,154 | 9,363 | 21% | (5 years) |

| 31-Mar-02 | 62,131 | 7,977 | 15% | (5 years) |

| 31-Mar-07 | 63,951 | 1,820 | 3% | (5 years) |

| 31-May-12 | 114,782 | 50,831 | 79% | (5 years, 2 months) |

| Under construction 5/31/12 | 87,122 | 76% |

2012: The plant boom shows signs of slowing, but hundreds of projects remain in the pipeline

In August 2011, a study by Prayas Energy Group found approximately 590,000 megawatts (MW) of coal projects in the pipeline, having received or expecting imminent environmental approval.[6][7] However, since the release of the Prayas study there has been a major slowdown among planners of new coal capacity. As shown in Table 2, 41,650 MW of projects were deferred (i.e. progress was on hold) as of May 31, 2012, and an additional 22,420 MW of projects had been cancelled. The reasons for the slowdown were multiple: (1) Dramatic rises in the cost of imported coal; (2) Insufficiency in domestic coal output; (3) An unfolding domestic crisis over the integrity of the coal allocation process, known as "Coalgate," (4) Difficulties obtaining financing. Nevertheless, 87,122 MW or projects were under construction as of May 31, 2012 and an additional 68,200 MW of projects were in advanced development, having achieved most milestones (permits, water, land, coal, and financing).Table 2: Summary statistics for proposed coal plants in India

| Status | # of Plants | Capacity (MW) | Annual Tons of CO2 |

|---|---|---|---|

| Proposed | 133 | 157,122 | 929,169,540 |

| Early development | 114 | 157,002 | 928,462,853 |

| Advanced development | 58 | 66,220 | 391,605,267 |

| Construction | 109 | 87,122 | 515,213,441 |

| Newly commissioned (since 1/1/2010) | 62 | 37,378 | 221,042,309 |

| Deferred | 30 | 50,270 | 297,281,739 |

| Cancelled | 19 | 22,420 | 132,585,172 |

| Unconfirmed | 20 | 24,685 | 145,979,704 |

| Uncertain | 6 | 14,660 | 86,694,854 |

| Total | 551 | 616,879 | 3,648,034,879 |

For a complete table of over 400 proposed coal plants in India, sortable by state, project name, sponsor, size, status, and CO2 emissions, see Proposed coal plants in India.

Ultra Mega Power Projects

For more details, see Ultra Mega Power Projects in India.India has proposed a series of 'ultra mega' coal-fired power stations of 4,000 megawatts or more.

The program of Ultra Mega Power Projects (UMPP) was introduced in 2005 by the Ministry of Power in association with the Central Electricity Authority and the Power Finance Corporation to overcome bureaucratic obstacles hindering the development of large thermal plants and thereby address India's chronic power deficits.[8] "The government’s capacity addition programme has been grossly inadequate in the past. In the 9th and 10th Plans, less than 50% of the targeted capacity was added. In the on-going 11th Plan, while the Centre had originally planned to add 768,577 MW [sic - one digit too many] of capacity, the power ministry has now scaled down the target to 62,000 MW," wrote Amiti Sen & Subhash Narayan in the Economic Times.[9] The Ministry of Power stated that the projects would be 'super critical' coal plants which would either be located at the pithead of specific coal deposits or at coastal projects to be based on imported coal.

In an attempt to make the projects attractive for private sector investors, the Ministry of Power, the Central Electricity Authority and the Power Finance Corporation determined that it "was deemed necessary to provide the site, fuel linkage in captive mining blocks, water and obtain environment and forests clearance, substantial progress on land acquisition leading to possession of land, through a Shell Company." The shell companies were also given the initial task for finalizing agreements with power purchasers.[10]

The Ministry stated that the Central Electricity Authority (CEA) had selected the sites in consultation with state governments with the coastal sites being the Mundra, Krishnapatnam, Tadri, Girye, and Cheyyur projects. The mine pithead sites are the Sasan, Tilaiya, Sundergarh and Akaltara projects.[10]

Here is the status of proposed Ultra Mega Power Projects as of July 2012:

| State | Plant | Company | MW | Annual CO2 (tons) | Type | Status | Year |

|---|---|---|---|---|---|---|---|

| Andhra Pradesh | Krishnapatnam Ultra Mega Power Project 1-2 | Reliance Power | 1320 | 7,806,085 | Deferred | 2013 | |

| Andhra Pradesh | Krishnapatnam Ultra Mega Power Project 3-6 | Reliance Power | 2640 | 15,612,170 | Deferred | 2015 | |

| Andhra Pradesh | Pudimadaka Ultra Mega Power Project | NTPC | 4000 | 23,654,803 | Supercritical | Advanced development | |

| Andhra Pradesh | Vadarevu Ultra Mega Power Project Stages II-III | Andhra Pradesh Power Generation Corporation (APGENCO) | 2400 | 14,192,882 | Proposed | ||

| Andhra Pradesh | Varadevu Ultra Mega Power Project Stage I | Andhra Pradesh Power Generation Corporation (APGENCO) | 1600 | 9,461,921 | Early development | ||

| Chhattisgarh | Akaltara Ultra Mega Power Project | Akaltara Power | 4000 | 23,654,803 | Deferred | ||

| Chhattisgarh | Surguja Ultra Mega Power Project | not selected | 4000 | 23,654,803 | Uncertain | ||

| Gujarat | Tata Mundra Ultra Mega Power Project 1 | Tata Power | 800 | 4,730,961 | Supercritical | Newly commissioned | 2011 |

| Gujarat | Tata Mundra Ultra Mega Power Project 2-3 | Tata Power | 1600 | 9,461,921 | Supercritical | Construction | 2013 |

| Gujarat | Tata Mundra Ultra Mega Power Project 4-5 | Tata Power | 1600 | 9,461,921 | Supercritical | Advanced development | 2014 |

| Jharkhand | Tilaiya Ultra Mega Power Project 1-5 | Reliance Power | 3300 | 19,515,213 | Supercritical | Early development | 2015 |

| Jharkhand | Tilaiya Ultra Mega Power Project 6 | Reliance Power | 660 | 3,903,043 | Supercritical | Early development | 2017 |

| Madhya Pradesh | Sasan Ultra Mega Power Project 1-2 | Reliance Power | 1320 | 7,806,085 | Supercritical | Construction | 2013 |

| Madhya Pradesh | Sasan Ultra Mega Power Project 3 | Reliance Power | 660 | 3,903,043 | Supercritical | Construction | 2014 |

| Madhya Pradesh | Sasan Ultra Mega Power Project 4-5 | Reliance Power | 1320 | 7,806,085 | Supercritical | Construction | 2015 |

| Madhya Pradesh | Sasan Ultra Mega Power Project 6 | Reliance Power | 660 | 3,903,043 | Supercritical | Construction | 2016 |

| Maharashtra | Devgad UMPP | NTPC | 4000 | 23,654,803 | Uncertain | ||

| Maharashtra | Girye Ultra Mega Power Project | not yet determined | 4000 | 23,654,803 | Deferred | ||

| Orissa | Ghogarpalli Ultra Mega Power Project | Power Finance Corporation | 4000 | 23,654,803 | Proposed | ||

| Orissa | Sakhigopal Ultra Mega Power Project | Power Finance Corporation | 4000 | 23,654,803 | Proposed | ||

| Orissa | Sundargarh Ultra Mega Power Project (Lankahuda) | NTPC | 4000 | 23,654,803 | Proposed | ||

| Tamil Nadu | Cheyyur Ultra Mega Power Project | Coastal Tamil Nadu Power | 4000 | 23,654,803 | Proposed | ||

| Tamil Nadu | Marakkanam Super Thermal Power Project | NTPC | 4000 | 23,654,803 | Proposed |

Financing of India's coal plants

Financing of India's coal rush is an under-studied topic. The Power Finance Corporation is the lead government-owned entity, and it is the "nodal agency" for the program of Ultra Mega Power Projects. International public investment institutions such as the World Bank have also played a significant role in financing India's coal plants, and that role has been highly controversial due to the application of funds from the Clean Development Mechanism for new coal plants. Private equity has been a smaller factor but is growing rapidly.[11]- Barh power station

- Bhilai Works power station

- Ib Valley power station

- Kahalgaon power station

- Krishnapatnam Ultra Mega Power Project

- Krishnapatnam power station

- Mumbai Jindal power station

- Mundra Ultra Mega Power Project

- Pathadi power station

- Simhadri power station

- Sipat power station

Domestic Coal Mining

Between 1996 and 2005 Indian hard coal production increased from 285 million tonnes to 397.7 million tonnes in 2005. In addition, 37.1 million tonnes were estimated to have been imported in 2005 with a total coal consumption of 433.4 million tonnes. The World Coal Institute estimates that coal demand could grow to 758 million tonnes in 2030.[12]In 2011 it was reported that India was the third largest miner in the world and will produce around 554 million tonnes of coal, but will burn 696 million.[13][14]

Government sources said the production target for Coal India (CIL) is likely to be set at 464 million tonnes (MT) for 2012-13. CIL has decreased its current production target to 440 MT from 452 MT, and has also decreased its production target for the 2011-12 to 448 MT. CIL has emphasized delays in the grant of forestry and environmental clearances for decreased output.[15] Other problems include coal shortages and high fuel prices.[16] In January 2012 the chairman of CIL, Nirmal Chandra Jha, is quoted as saying delays in rail construction has been a major factor in lower than expected coal output. He stated, "For over a couple of years, our production has not grown, but our inventory at rail sidings all across kept piling up." One rail project connecting the Vasundhara and Mand-Raigarh rails had a completion date of March 2012 (end of 11th Five Year Plan) but is currently not close to completion, with one connector track not yet started.[17]

It was reported in July 2012 that the ministry of environment and forest gave conditional approval to 15 mines operated by PSU coal miner Coal India.[18]

Coal leases

In March 2012, it was reported that India’s government lost hundreds of billions of dollars by selling coalfields to companies without competitive bidding, according to a leaked audit report that the auditor itself called misleading. Opposition party leaders demanded an explanation from Prime Minister Manmohan Singh of why about 155 coalfields were sold to select private and state-run companies without competitive bidding, resulting in an estimated loss of nearly $210 billion.[19]Coal Reserves

A report issued by India think tank Energy and Resources Institute (TERI) in December 2009 estimated that the country has approximately 45 years' worth of usable coal reserves. Previous estimates from geological studies had suggested that India had about 267 billion tonnes of coal, including approximately 105 billion tonnes of proven reserves, which could last for up to 200 years. The TERI report said the revised estimate showed the importance of developing policy initiatives for renewable energy, including aggressive promotion of solar energy technologies. Rajendra Pachauri, TERI's director-general, said, "It's a myth that India has a virtually unlimited supply of coal. Much of our coal is so deep that it cannot be mined." According to the report, India will have to increase its coal imports to about 1,300 million tonnes per year by 2030, unless initiatives are launched to lessen the country's dependence on coal - if renewable energy initiatives are launched effectively, coal imports could be restricted to 200 million tonnes per year.[20]In August 2010, the EIA projected that India has coal reserves of 62,300 million short tons.[21]

In May 2011, the coal ministry said it plans to redefine the boundaries of 28 coal blocks in the country, to "help in improving availability of the essential fuel by 34 per cent." Out of a total 602 coal blocks in nine coalfields in the country, the environment ministry said the available areas for mining in the country would increase by up to 64 per cent from 59 per cent, according to estimates of the coal ministry.[22]

On June 24, 2011, India Environment Minister Jairam Ramesh approved coal blocks in Chhattisgarh, after overruling the Forest Advisory Committee. Out of three blocks - Parsa East, Kante Basan and Tara in the Hasdeo-Arand forest region - the first two are allotted for Rajasthan and third is for Chhattisgarh.[23]

Major Indian Coal Companies

The World Coal Institute states that "almost all of India's 565 [coal] mines are operated by Coal India and its subsidiaries, which account for about 86% of the country's coal production. Current policy allows private mines only if they are ‘captive' operations, i.e. they feed a power plant or factory. Most of the coal production in India comes from opencast mining, contributing over 83% of the total production. Coal India employs some 460,000 people and is one of the largest five companies in India."[24]The USGS estimates coal production from major wholly Coal India owned subsidiaries as being:

- Bharat Coking Coal Limited;

- Bihar Coking Coal Ltd which operates in Bihar and West Bengal and has an annual capacity of 26 million tonnes;

- Central Coalfields Ltd which operates in Bihar and has an annual capacity of 27 million tonnes;

- Eastern Coalfields Ltd which operates in Bihar and West Bengal and has an annual capacity of 21 million tonnes;

- Mahanadi Coalfields Ltd which operates in Orissa and has an annual capacity of 21 million tonnes;

- North-Eastern Coalfields Ltd which operates in Assam and has an annual capacity of 640 million tonnes;

- Northern Coalfields Ltd which operates in Indian Madhya Pradesh and Uttar Pradesh and has an annual capacity of 24 million tonnes;

- South Eastern Coalfields Ltd. which operates in Madhya Pradesh and has an annual capacity of 36 million tonnes;

- Western Coalfields Ltd. which operates in Madhya Pradesh and Maharashtra and has an annual capacity of 18 million tonnes;

- Neyveli Lignite Corporation which operates in Tamil Nadu and has an annual capacity of 17 million tonnes of lignite.

Children miners

An estimated 70,000 children work in the coal mines in the Jaintia Hills in northeast India, according to Impulse, a children’s rights organization working to end the practice. The youngest of the miners are just 7 years old. An article in The Christian Science Monitor reported that many work for a few dollars a day – $5 per cartload of coal – in narrow, unreinforced seams in 5,000 small mines. Most are Nepalese, who are allowed to apply to work there, but many are Bangladeshis, who are there illegally. Others are Indian. Some have been sold by their families as indentured laborers, according to Impulse.[27]The number of children working in the state's 5,000 coal mines is a matter of dispute, with Impulse estimating tens of thousands and local politicians putting it in the hundreds. In May 2011, the LA Times reported that most of the children miners work in Meghalaya, where the government "with only seven labor inspectors and no vehicle, all but ignores child labor and safety problems, keen to goose the economy" and that the government "acknowledged that 222 children worked in 20 villages mining and hauling coal and doing related jobs, but it has done nothing to rescue them."[28]

Coalbed methane in India

On January 4, 2011, Great Eastern Energy said it had signed an agreement with the Tamil Nadu government for the development of gas reserves lying below coal seams in the Mannargudi block in the state. Great Eastern was awarded the Mannargudi block located near Tiruchirapalli in June 2010 in the fourth round of bidding for Coal Bed Methane (CBM) blocks. Great Eastern is the first company to commercially produce CBM in India. Great Eastern is currently producing CBM from its block in Raniganj, West Bengal, and is already supplying CBM to various industrial customers in and around Asansol/Durgapur, West Bengal as well as syngas to vehicles through India Oil petrol pumps and, potentially, Bharat Petroleum outlets as well. The Mannargudi block is spread over an area of 691 sq km and the CBM resource is estimated at 0.98 trillion cubic feet.[29]Mining Deaths

The Union Ministry of Coal released information stating that 342 people died in accidents in mines operated by public sector undertakings (PSUs) over the past four years. "Experts say that non-compliance with safety regulations have led to these deaths." The companies with the most accidental deaths are the South Eastern Coalfields Limited (SECL) with 67 deaths, Singareni Collieries Company Limited (SCCL)with 54 deaths, and Western Coal Limited (WCL) with 51 deaths. The government ascribes most of the accidents to roof collapse, inundation, explosion of fire damp, coal dust explosion, premature collapse of workings, ignition of fire damp, water gas explosion and fire/suffocation by gases. "All these companies are subsidiary companies of Coal India limited (CIL)." Souparno Banerjee of Centre for Science and Environment (CSE) argues that "safety practices in most mines are inadequate"... "Even the health aspect of miners is being neglected which causes casualties in the long term," he said.[30] However, not all mining deaths are reported. In the state of Meghalaya, some state laws overrule national ones. Some state laws were enacted to protect small coal industries, but "many mines are owned by state and national lawmakers or their relatives". "[D]eaths in Meghalaya aren't recorded or investigated, with most hushed up to avoid mines being shuttered." [31]Trapped Miners

During a major power blackout in India in late July 2012, two hundred workers became stranded in three coal mines in West Bengal when a blackout affecting half the country cut off electricity to elevators in their underground pits, a mining company official said.[32]Proposed coal projects

Proposed coal-to-liquids projects

In March 2009 the Indian government announced that it had awarded two coal blocks for the development of two different coal-to-liquids projects in the state of Orissa. These are:- the north Arkhapal coal block to Strategic Energy Technology Systems Ltd, a 50:50 joint venture between Tata Power and Sasol Synfuels International, the international synfuels subsidiary of Sasol. It is projected that the $10 billion.[33] plant would produce 80,000 barrels of crude oil a day.[34] In early 2010 Orissa's Chief minister Naveen Patnaik told reporters that "though we have not identified the location, the proposed plant will be somewhere in the state." It was also reported that the coal would come from the Srirampur area in Talcher. The Business Standard also stated that the project "requires 3,000 acre of land for its main plant, additional land would be required for setting up coal mines, benefication plants, coal handling plants, water reservoirs, power plants and a township" and would involved the establishment of a 1600 megawatt power station. The newspaper also reported that the joint venture was "yet to make a formal application" for the plant the company was pressing the state government "to provide adequate facilities for early commissioning of the project."[35] (See Srirampur Coal-to-Liquids Project for more details).

- the Ramchandi block to Jindal Steel and Power Limited (JSPL) is projected to produce 80,000 barrels per day will use the German Lurgi technology. The plant is proposed to be established at Kishore Nagar in Angul district of Orissa. Waste coal from the washery is proposed to be used as fuel for a 1,350MW power station. [34] (See Kishore Nagar Coal-to-Liquids Project for more details).

Estimated number of new plants approved

According to the Sierra Club, India approved 173 coal fired power plants in 2010.[36]According to Economic and Political Weekly, if you count only projects that have a capacity of 500 MW or above, data from the Ministry of Environment and Forests (MoEF) indicates that since 2006, environmental clearance has been given to nearly 200 thermal coal projects for generating close to 220,000 MW of power: "To put this number in perspective, the total existing electricity generation capacity in the country – from thermal, nuclear, hydro, and other sources – was just over 176,990 MW at the end of June 2011 (CEA 2011). The thermal generation capacity expansion underway works out to 1.3 times the total generation capacity in the country." The top six coal-mining states – Jharkhand, Orissa, Chhattisgarh, West Bengal, Madhya Pradesh (MP), and Andhra Pradesh (AP) – account for close to half of the capacity addition. Tamil Nadu, Maharashtra and Gujarat account for a third. The remaining is spread across Uttar Pradesh (UP), Bihar, Haryana, Rajasthan, Karnataka, Punjab, Delhi and Tripura.[37]

According to an August 2011 report by Prayas Energy -- a non-governmental, non-profit organisation based in Pune -- the India Ministry has so far given environmental clearances to coal and gas-based power plants whose capacity totals 192,913 MW, while another 508,907 MW are at various stages in the environmental clearance cycle, for a total of 701,820 MW. Coal-based plants account for 84% of the projects. These additions are more than six times the currently installed thermal capacity of 113,000 MW.[38]

Andhra Pradesh, India

As of 2011, the installed capacity in the state of Andhra Pradesh is 15,800 MW. According to a survey by the Central Electricity Authority, the peak electrical demand in the state is expected to reach 28,215 MW by 2021. According to Grist, there are 117 proposed power plants in the state, geared to generate an additional 77,800 MW; of this, 55,925 MW will be coal-based.[39] According to the Guardian, seven major and more than 30 smaller coal-powered power stations are planned, together intended to have a capacity of 56GW.[40]There has been community resistance against coal plants in Andhra Pradesh, particularly in the Srikakulam District, where six coal plants are proposed including the Nagarjuna Construction Company Sompeta Thermal Plant, and the Krishnapatnam port, where 24 plants are proposed. Police are reported to be unleashing violence and intimidation to suppress villagers as they struggle to protect their livelihood and habitats.[41]

The Nagarjuna Construction Company Sompeta Thermal Plant is a 2640 MW coal-fired power plant proposed for Sompeta in Andhra Pradesh, India. In the wake of highly publicized protests and the killings of local residents by police, the project's environmental clearance was revoked by the ministry of environment and forests in July, 2010.[42]

The Bhavanapadu Thermal Power Project is a 2,640 megawatt (MW) coal-fired power station proposed by East Coast Energy to be constructed in Andhra Pradesh, India.[43]

Environment Minister approves sixteen coal projects

On February 11, 2011 India's Environment Minister Jairam Ramesh approved a total of sixteen new coal projects that were on hold due to environmental regulations. Coal Minister Sriprakash Jaiswal stated that the environment minister’s okay of Coal India's proposed coal mine projects was due to pressure from higher levels in the Indian government. The Coal Minister also stated that environmental regulations are one of the reasons why the growth of Coal India – which produces 80 percent of the country's coal – dropped to 2 percent in 2010, compared to 2009's figure of almost 7 percent. However, the Coal Minister said the areas off limits to coal mining would remain off limits, despite the likely increase in the country's coal use.[44]DB Power's proposed Dharamjaigarh coal mine and plant

DB Power is a subsidiary of DB Corp Ltd, a media conglomerate in India. DB Power is seeking the acquisition of 693.32 hectares of land for a coal mine, a project in Dharamjaigarh that would displace an estimated 524 families from six settlements to extract 2 million tonnes of coal annually. The coal would be used to fuel a 1320 MW thermal power plant that would be built in the adjoining district of Janjgir. After public protest against the proposed mine, DB Power submitted an affidavit pledging not to conduct any mining operations in nagar panchayat land. A supplementary letter filed at a Feb. 2011 public hearing promised to re-site any proposed water tanks and coal piles from nagar panchayat land to the remaining leased area. Four villages, however, would still lose their lands.[45]The shortage of coal, rising coal prices, and the effect on proposed plants

Forty-two gigawatts of planned capacity has been mothballed as of Jan. 2012, due to coal supply bottlenecks and price curbs. Utilities won rights to build plants by bidding prices at which they would sell electricity. The utilities that have put additional coal capacity on hold had bid to sell electricity at an average of 2.5 rupees (5 cents) a kilowatt-hour, while current fuel prices put the cost of producing power at about 3 rupees a kilowatt-hour, slowing the growth of coal plants.[46]The coal crisis has made financiers such as Infrastructure Development Finance Company (IDFC) wary of coal projects. In December 2011, IDFC managing director and CEO Rajiv Lall told The Times of India that IDFC was halting its financing of new coal-fired power plants. In an interview, Lall said,

- "The biggest problem is in the power sector due to (un) availability of fuel, notably coal, and due to continuing challenges of the state electricity boards (SEBs). Coal India never really believed that we can add 50,000 mw capacity addition in the plan period. It was unprepared to meet the extra demand. It is also true that they have had challenges in terms of developing new mining assets because of the environment debate. Thousands of crores ave been invested in generating plants that are about to come on stream and will not have enough coal to allow them to function at their optimal capacity. This has all kinds of potential knock-on effect. As cash generation will decline, debt servicing capacity shrinks, banks will have to either restructure loans or they will have less capital to fund growth. As banks become nervous on funding such projects, they are not financing to build more capacities. Problems in land acquisition and environment have led to most entrepreneurs losing risk appetite. Public sector banks are not lending to SEBs. The structural problems can't be brushed under the carpet and tariffs have to be raised, which some states have done. We don't have any exposure to SEBs. We have ring-fenced our exposure to coal-fire projects very well. But if SEBs start defaulting, then we can't help it. We are basically not lending to new coal-fired projects... We will not get back to thermal until a couple of these issues are solved."[47]

Coal Exports

India has almost negligible coal exports, estimated to be at only 1.5 million tonnes in 2005.[12]Coal Imports

Note: 1 metric ton (tonne) = 1.10231 short tons

| Country | 2006 | 2007 | 2008 | 2009 | 2010 |

|---|---|---|---|---|---|

| India | 52.7 | 29.6 | 70.9 | 76.7 | 101.6 |

In 2009, India imported 67 mega tons (Mt) of coal, according to estimates by the World Coal Institute.[49] According to the U.S. EIA, in 2009 India mined 613.4 million, imported 77 million, and used 680.9 million short tons of coal.[50]

Indian coal imports are rising rapidly. According to India Coal Market Watch, from April 2008 through March 2009, the country imported 59 million metric tons (tonnes); from April 2009 through March 2010 imports rose 24 percent to 73.25 million tonnes.[51] India’s coal imports rose by 14 percent from 2009, to 86.28 million metric tons in 2010.[52]

In 2010, Chairman of Coal India Partha Bhattacharyya projected that India may import close to 100 million metric tons of coal in the year 2010 - ending March 31, 2011 - to meet growing demand, as India generates 70% or more of its electricity by burning coal.[53] In February 2011, Coal Minister Sriprakash Jaiswal projected that 2010/2011 imports would jump 70 percent to 142 million tonnes.[54] In September 2011 it was announced that the country could import approximately 114 million tonnes of coal in 2011/12, up by over a third from the 2010. Imports will come primarily from Indonesia and South Africa.[55] It was also reported that coal imports were up about 70 percent in the first six months of the year ending March 2011; [56]between April-October 2011, coal imports rose 51% compared to the same period during the previous year.[57]

In 2011, coal imports rose an estimated 7.6% from 2010 to 118.4 million metric tons. This fell short of previously projected imports due to economic factors. [58] It was announced in March 2012 that India's Coal Ministry was looking to remove a duty on coal imports to the country, potentially making it easier to import coal into India.[59]

In July 2012 Coal India reported that they planned to import up to 30 million metric tons of coal in 2012 in order to meet rising domestic demand and mitigate power shortages.[60]

Terminals

India is dependent on a number of coal terminals to bring these imports into the country. (See map at bottom of page.)India coal ports

| Terminal | State/Province | Operator | Annual Capacity (MM Tonnes) |

|---|---|---|---|

| Bedi Port | Gujarat | ||

| Cochin Port | Kerala | 0.3 | |

| Dahanu Port | Maharashtra | ||

| Dahej Port | Gujarat | ||

| Dharamtar Port | Maharashtra | ||

| Ennore Port | Tamil Nadu | ||

| Gangavaram Port | Andhra Pradesh | Gangavaram Port Ltd. | 10 |

| Haji Bunder Port (MBFL) | Maharashtra | Mumbai Port Trust | |

| Haldia Port | West Bengal | ||

| Nhava Sheva Port | Maharashtra | Jawaharlal Nehru Port Trust | |

| Kakinada Port | Andhra Pradesh | ||

| Kandla Port | Gujarat | ||

| Karaikal Port | Puducherry | ||

| Krishnapatnam Port | Andhra Pradesh | ||

| Magadalla Port | Gujarat | ||

| Mormugao Port | Goa | 6.5 | |

| Muldwarka Port | Gujarat | ||

| Mundra Port | Gujarat | Adani Enterprises | 40 |

| New Mangalore Port | Karnataka | ||

| Okha Port | Gujarat | ||

| Panjim (Panaji) Port | Goa | ||

| Paradip Port | Orissa | 20 | |

| Pipavev Port | Gujarat | APM Terminals | |

| Porbandar Port | Gujarat | ||

| Port of Chennai | Tamil Nadu | 15 | |

| Sikka Port | Gujarat | ||

| Tuticorin Port | Tamil Nadu | 10 | |

| Visakhapatnam Port | Andhra Pradesh |

Future imports

Tata Power, a Tata group company, is looking for a strategic stake in Indonesian and South African coal mines for supply of 6-8 million tons of coal to fuel its 2x800MW thermal power project, the Mundra Ultra Mega Power Project. The company targets to acquire a stake that will assure 8-9 million tons of coal supply.[61] Tata Power is also seeking out coal from East Kalimantan and Mozambique.[62]Coal India (CIL) plans to forge new deals with a mix of domestic and foreign companies. The latter includes BHP Billiton, Rio Tinto, and Vale of Brazil, as well as Vedanta Resources, a London-based metals producer that has embarked on a US$10 billion expansion of Indian coal mining to also increase its output of zinc, lead, and silver, and to power its expanding Jharsuguda aluminum smelter in Orissa. The Coal Ministry in early 2010 announced it was "encouraging" CIL to acquire or develop coal mining operations in Mozambique, Australia, Indonesia, South Africa and the US. The state company is also negotiating with Peabody Energy for stakes in four Australian mines, aimed at producing12 mt per annum by 2012.[62]

On August 2, 2010, news reports said India's Adani Group will buy a coal tenement in Queensland's Galilee Basis from Australia's Linc Energy. The deal could be worth more than 1 billion Australian dollars (900 million US), and would be the first time an Indian company has bought a coal seam rather than invested in a coal mining company. Adani is India's largest coal importer and a key player in India's plans to double power generation over the coming decade: there are 28 coal-fired plants under construction and another 28 on the drawing board. The value of shares in Linc has risen nearly 60 per cent since the start of July in anticipation of the sale of three Queensland coal assets. Linc's primary business is coal seam gas.[63]

It was announced in November 2011 that Coal India was in talks with Peabody Energy and Massey Energy about acquiring two of the companies' mines. Coal India has budgeted $1.2 billion to buy assets in the U.S., Indonesia and Australia during the year ending March 2011 as it battles a widening gap between domestic coal supply and demand.[64]

In early January 2011, MMTC, India's largest state-run trading company, announced that India was going to increase its coal imports from South Africa. Indian demand for South Africa’s coal contributed to Asia overtaking Europe in 2009 as the largest shipping destination for the fuel used in power plants.[65]

NTPC, India's largest state-owned energy provider, is "exploring" bilateral pacts with African nations to increase coal imports. Mozambique currently has such an arrangement with India.[66] The first shipment of 37,600 metric tons of coal was made January 18, 2012 by Vale, a private Brazilian based company.[67]

Peabody Energy Corporation reports that it will "rely on" demand for coal in India, among others, as demand in the United States decreases.[68]

In January 2012, Russia's Energy Minister Sergey Shmatko said the country will double its coal exports to Asia by 2030.[69]

BP's Energy Report details new projections that India will burn more coal than China by 2030. The report notes a plateau in Chinese coal demand following a stabilizing industrial system that will push India into the top spot.[70]

In July 2012 it was reported that India will need to import 185 million tons of coal annually by 2017 to the country's growing shortfalls. A draft paper by the government's commission on energy warned of "an urgent need to take effective measures to step up coal production".[71]

Indian company buys stake in Australian coal port

In April 2011, Indian company Adani Enterprises, the country’s largest coal importer, agreed to buy Australia's Abbot Point Coal Terminal for A$1.83bn ($1.98bn).The purchase was among a number placed by Indian groups in Australia and elsewhere as the country to secure energy resources to meet rising demand for power to complete infrastructure projects in India.[72]

Funding and Programs for Clean Energy and Climate Change

India Rejects Calls to Reduce Greenhouse Gas Emissions

In June 2009, Environment Minister Jairam Ramesh said that India will reject any international treaty to reduce greenhouse gas emissions. Ramesh said that the effort to cut global warming emissions should instead be undertaken by industrialized countries. Ramesh said India has pledged to contain per capita CO2 emissions below those of developed nations, but said, "There is no way India is going to accept any emission reduction target, period, between now and the Copenhagen meeting and thereafter."[73]India carbon tax

On July 1, 2010, India imposed a carbon tax on coal producers, and expects to raise $535 million, the first step by Asia’s third-largest energy consumer to charge companies for fossil fuel pollution. Coal, used to fire more than half of India’s electricity generation, will be taxed at 50 rupees a metric ton to help fund clean-energy projects. Coal producers nationwide will be charged the tax starting July 1, 2010, the Central Board of Excise and Customs said in a notice on its website after the levy was proposed in the federal government budget in February. The clean-energy levy will also apply to imported coal, Finance Minister Pranab Mukherjee said in his budget speech. Coal emits more carbon dioxide per unit of energy than other fossil fuels, according to the U.S. Energy Information Administration.[74]India and climate change mitigation

In August 2010, the Indian government announced it was sanctioning $6.4 billion to finance efforts to mitigate the impacts of climate change on the environmentally sensitive and populous areas of the country. The funds will be used to achieve the targets and goals mentioned in the National Action Plan on Climate Change released by the Prime Minister's Council on Climate Change in 2008. The plan of action to mitigate the impacts of climate change have been subdivided into eight broad categories covering the most critical areas: energy efficiency, solar energy, sustainable agriculture, water conservation, sustaining the Himalayan ecosystem, and building a knowledge base for understanding climate change and its impacts better.[62]India and renewable energy

In May of 2011 it was reported that India plans to invest $37 billion to create 17,000 MW of renewable energy generation by 2017, the Ministry for New & Renewable Energy said in a statement. The projected investment would come primarily from the private sector.The current operating renewable energy capacity in India is 20,000 MW, which accounts for 11% of the total power capacity in the country. The major share of power as of 2011 comes from coal which accounts for 40% of the country’s energy usage.

The Indian government had quadrupled its renewable energy targets earlier in 2011 as part of its national plan to reduce carbon intensity which aimed at installing 74.4 GW of renewable energy capacity by 2022 and reduction in carbon emissions intensity by 20-25% of 2005 levels over the next ten years.[75]

In February 2012, India's largest state-run lender to electricity utilities, Power Finance Corporation, announced it will increase lending to wind and solar plants from 1.2% to 4% of its total lending budget. Chairman Satnam Singh cited the volatility of coal prices as a factor in the decision. Praveen Kadle, managing director for Tata Capital Ltd., says escalating investment risk in coal plants has movitaved some investors to take their money elsewhere.[76]

Reports

Health costs of coal

The 2013 study "Coal Kills: An assessment of death and disease caused by India's dirtiest energy source," conducted by the NGOs Conservation Action Trust (CAT), Urban Emissions, and Greenpeace looked at emissions data of 111 coal-fired power plants (generation capacity of 121GW) and found that in 2011-2012:- emissions from Indian coal plants resulted in 80,000 to 115,000 premature deaths and more than 20 million asthma cases from exposure to total PM10 pollution; and

- the monetary cost associated with the health impacts of coal exceed Rs.16,000 to 23,000 crores (USD $3.3 to 4.6 billion) per year.

New coal plants

According to the 2011 report "Thermal Power Plants on The Anvil : Implications And Need For Rationalisation" by Prayas (Initiatives in Health, Energy, Learning and Parenthood) -- a non-governmental, non-profit organisation based in Pune -- the India Ministry has given environmental clearances to coal and gas-based power plants whose capacity totals 192,913 MW, while another 508,907 MW are at various stages in the environmental clearance cycle, for a total of 701,820 MW. Coal-based plants account for 84% of the projects. These additions are more than six times the currently installed thermal capacity of 113,000 MW.Many of the projects in pipeline will be geographically concentrated in a few areas: 30 districts (4.7% of the total 626 districts in India) will have more than half of the proposed plants, with their capacity adding up to about 380,000MW. Fifteen districts each have plants with capacities totaling 10,000 MW or more. Districts Janjgir-Champa and Raigarh in Chhatisgadh have the highest concentration of proposed plants in the country, with 30,470 MW and 24,380 MW planned, followed by Nellore in AP with 22,700 MW. The districts of Rewa (17,820 MW), Singrauli (15,240 MW), Sonbhadra (7,638 MW), Sidhi (5,240 MW, not in the top 30) and Allahabad (5,280 MW, not in top 30) are adjoining, and add up to a proposed capacity of 51,218 MW.

The private sector accounts for 73% of all projects, with 10 private corporate groups planning to build about 160,000 MW.

The report argues that: "These projects in pipeline represent a massive overcapacity in the making. Thus, valuable and scarce natural resources of land, water, gas and coal will be allocated to projects that are not required. Crucially, land for such TPPs [thermal power plants] is invariably acquired compulsorily by governments by using the Land Acquisition Act (LAA), which allows forcible acquisition for a public purpose. Given that the thermal capacity in pipeline is far in excess of that required, it is clear that many of these plants will not serve a public purpose. Hence, the use of the LAA to acquire land for such TPPs cannot be justified.

"...The report therefore recommends an immediate moratorium on any further environmental clearance to new power plants. Further, it also recommends that from the 200,000 MW that have already been given environmental clearance, projects with very high social and environmental impacts, projects that do not have broad local acceptance, and projects leading to sub-optimal use of transmission, fuel, land and water should be put on hold. It also calls for simultaneously initiating a fully transparent deliberative process to (a) completely revamp the environmental clearance procedures of power plants, so as to minimise social and environmental impacts of power projects, and mandate prior regional carrying capacity studies to decide on the extent of projects in an area, (b) to ensure a coordinated approach of different agencies for optimising fuel, land and water allocations for different projects and (c) to reassess the long term demand for power and measures to meet this demand in an optimal manner, including energy efficiency as well as renewable energy, so as to improve energy security and minimise the social and environmental damage due to power sector development."[77]

Citizen Action

Arrest of indigenous rights activists

On May 28, 2011, two indigenous rights activists, Ramesh Agrawal and Dr Harihar Patel, were arrested in the central Indian state of Chhattisgarh and denied release on bail.The state police charged the two men with “circulating defamatory material”, “disrupting public order” and “causing alarm and panic among the public” at a May 8, 2010 mandatory public consultation, held by the state pollution board at Tamnar village, relating to the proposed expansion of a coal-fired plant run by Jindal Steel and Power.

Agrawal and Patel expressed concerns that the expansion would lead to the forcible acquisition of lands from the surrounding local communities by the authorities. The two activists had objected to the proposal and cited an official inspection report which stated that the expansion began before the mandatory clearances were given. Ramesh Agrawal also successfully petitioned India’s Ministry of Environment and Forests to temporarily suspend the terms of reference for the expansion. Following a complaint relating to the delay, the state authorities decided to arrest the two activists.

Ramesh Agrawal works for the environmental rights organization Jan Chetna, and Dr Harihar Patel practices indigenous medicine. They had been actively campaigning against the pollution caused by existing industrial projects, including coal plants, and the potential negative environmental impact of proposed industrial projects in central Chhattisgarh. The two activists have been at the forefront of the campaign for the public disclosure of information relating to projects which affect local Adivasi (Indigenous) communities and for ensuring that these are available to the communities. Their arrest, Amnesty International believes, is intended to stop their peaceful campaign activities.

The two activists were sent to Raigarh prison until June 3, 2011, and a local court rejected their appeals for release on bail on June 2. Ramesh Agrawal, who complained of hypertension, was taken for treatment at a government-run hospital where he is being kept chained to his bed.[78]

World Bank financing

In October 2010 Green groups criticized the U.S. Export-Import Bank (Ex-Im Bank) for its expected final approval of hundreds of millions of dollars in subsidized federal financing for the 4,000 megawatts (MW) Sasan coal power plant and mine in India.The groups also accused the Bank of falsely linking renegotiation of the coal financing to a renewable energy project.

“Ex-Im Bank flip flopped on this massive climate-damaging project--and belly flopped on the first major test of the agency’s carbon policy,” said Michelle Chan, director of the economic policy program at Friends of the Earth.[79]

Community impacts and resistance

The United Nations estimates that more than 25 percent of India’s 1.2 billion people live without electricity. Yet many communities protest new coal mines and plants because it displaces them from their land, and they do not receive the electricity generated.[80]August 2007: 6,000 people face displacement in Madhya Pradesh

Five villages -- Sidhikhurg, Sidhikala, Tiyara, Jhanjhi, and Harrhawa -- covering approximately 3,000 acres and with a population of 10,000 people are slated for displacement by the Sasan Ultra Mega Power Project in the far western corner of Madhya Pradesh, a state located in central India. The project will use caol from coal mines located 20 to 25 kilometers away, in Mohar, Amlori, and Chatrasal. The project is sponsored by Reliance Power.[81]July 2010: Two killed, 150 injured in Andhra Pradesh

On July 14, 2010, police in Adhra Pradesh's Srikakulam district fired on farmers and fisherman protesting a 2,640 MW coal plant under construction by Nagarjuna Construction Company (NCC), killing two. In addition, 150 people were injured, including 45 policemen, during clashes between protesters and police. In the wake of the violence, police were deployed in about a dozen villages and banned assembly by more than five persons.[82]January 2010: Hanakon thermal project shelved after intense protest; protesters tortured

January 2011: 25 people injured in Chhattisgarh protests

On January 17, 2011, at least 25 people were injured and over a hundred were taken into custody during protests by farmers against land acquisition by KSK Energy Ventures Limited, sponsors of the 3,600 MW KSK Mahanadi Power Project at Nariyara village in the Akaltara district of Chhattisgarh, about 170 km from the state capital Raipur. At issue in the protests is the prime quality of the agricultural land being made available for an estimated 40,000 MW of power plants planned for the Janjgir-Champa district. State Congress president Dhanendra Sahu told reporters, "It's a foolish decision, Janjgir-Champa has highly productive farm land and also has access to irrigation facilities. This is a conspiracy by the state government to hand over farmers' prime land to industries."[88]February 2011: Two killed, 25 injured in Andhra Pradesh

"No power to people?"

April 2011: Four killed in protests against anti-encroachment drive in Jharkand

The state of Jharkhand is home to one of the largest Adivasi (tribal) populations in India. It is also the location of an estimated 40% of the country’s deposits of coal, iron ore, uranium and other minerals. Jharkhand’s Adivasis have farmed and hunted on the land for millennia, but do not hold title deeds, but as the original inhabitants of the Indian subcontinent, Adivasis have ancient land rights protected by law. They are, however, being forced to leave their ancestral lands to make way for new mines, steel mills and hydroelectric projects, with little or no compensation.[90]Following resistance by local residence against house demolitions at Matkoria, four people were killed in clashes with police attempting to clear land owned by Bharat Coking Coal Limited. In addition, 21 people were injured and 27 arrested. Among the arrested were former ministers Bacha Singh and OP lal, Congress MLA Manan Mallick, and deputy mayor Niraj Singh. A curfew was imposed on Dhanbad town.[91] Among those killed in the fighting was Vikash Kuman, an auto driver.[91] Another fatality was that of Sanjay Paswan.[92]The protesters blocked National Highway 32 between Dhanbad and Bokaro for several hours. Police used lathis and teargas to disperse protesters. A Mob set fire to offices of Bharat Coking Coal Limited at Kunsunda and Godhar. Protesters also set on fire a police check post in Matkuriya as well as three police vehicles. Nine people were reported in critical condition with bullet wounds. Among the injured were a half dozen members of the media, including four camera men. Most of those being subjected to the anti-encroachment drive had settled in the area 80 years earlier.[93]

May 2011: Mango farmers protest coal plants in Maharashtra's Ratnagiri district

Farmers marched to protest coal plants in Ratnagiri district of Maharashtra, in an area known as the Konkan Coast. The protests were organized by the Ratnagiri Zilla Jagruk Manch, an organization leading a campaign against seven thermal power plants proposed for the district. In Pawas, Ratnagiri district, villagers protested with a hunger strike.[94][95]In July 2011, JSW Energy - an Indian power producer controlled by the billionaire Jindal family - delayed expansion of a 3,200 MW coal plant in Ratnagiri as it waits for coal-pricing “clarity” from Indonesia and Australia.[96]

On June 2, 2011, a 15-member motorbike gang shot dead a realtor and two others at the Asansol courthouse in India, which the police said was likely a rivalry between coal mafias. Councillor Rohit Nunia from Kulti, a town 30km from Asansol whose municipality is run by a Trinamul-Congress alliance, is believed by police to be involved in coal smuggling and seeking revenge for an attempt on his life in December 2010, although a Left Front leader claimed the coal connection crosses political parties.

The 15 youths appeared suddenly, called realtor Ram Lakshman Yadav's name, and began shooting. Within seconds, the realtor, a guard, and Mukesh Singh, had slumped to the ground while the gang chased Kamalesh Singh to the basement. Mukesh was sent to a hospital in Durgapur while the other three were declared dead on arrival at an Asansol hospital. Yadav had been riddled with 10 bullets, sources said, and the other two slain men too had multiple wounds.

Jagmohan, the deputy inspector-general, said the slain realtor had two cases pending against him, one for possession of illegal arms in 1994 and the other for a murder attempt in 1999. Another officer said three suspects had been detained, including CPI councillor Nunia: “An attempt was made on Nunia’s life six months ago but he escaped unhurt. He was involved in smuggling coal out of the IISCO factory."[97]

September 2011: Moving Planet day of action

On September 24, an Indian delegation and US mountaintop removal activists will take part in "Moving Planet" day in support of fossil fuel-alternative energy, in West Virginia and India. The India delegation is calling on the World Bank to follow through with its proposal to dramatically cut funding for coal-burning power stations.[98]September 2011: Greenpeace calls for moratorium on new coal projects in Singrauli

After releasing the 2011 report, "Singrauli: The Coal Curse," Greenpeace called for a moratorium on new coal mining activities in the Singrauli region, based on the findings of a Greenpeace team in the region that the projects "deprive the livelihood of displaced people and ruin their health." According to Priya Pillai, the communities are living in an atmosphere which is full of coal dust: "The people gave up their land for power that doesn't reach them."In Singrauli, the Mahan, Chhatrasal, Amelia and Dongri Tal II forest blocks, which were earlier categorised as 'no go', are awaiting approval for coal mining from the government. Officially, 5,872.18 hectares of forest in the Singrauli region had been marked for non-forest use after the Forest Conservation Act came into force in 1980. According to the divisional forest officer of Singrauli, another 3,229 hectares have been proposed for such activities.

Singrauli is all set to become the country's "power capital" with a number of power plants coming up in Madhya Pradesh, apart from the nine open cast coal mines which are going to start production by 2014. The combined investment of all these projects is estimated to be over Rs 1 lakh crore.

November 2011: Activist nun who fought Indian mining companies brutally murdered

In mid-November 2011 Sister Valsa John, an anti-coal activist in India, was killed in her village of Pachwara, a small community in the eastern Indian state of Jharkhand. She was allegedly killed by individuals hired by coal mining companies. The individuals beat and hacked her to death. Sister Valsa was 52 and took her vows was a member of Sisters of Charity of Jesus and Mary. It was reported that on numerous occasions she had gone to the police after threats where made on her life. The following was written in the Globe and Mail following her death:- She was one of the remarkable breed of Indian religious figures who are grassroots social activists, who immerse themselves in the most marginalized and impoverished communities and work on literacy, basic health care and human rights. Sister Valsa said she did Jesus’s work by teaching the aboriginal people – known in India as adivasi or “tribals” – about their rights to their land.[99]

Prior to being killed, Sister Valsa John stood up for a rape victim in her community and a police report filed for the case. The alleged rapist, arrested days after the murder and later charged with that too, reportedly told the police that Sister Valsa was “an agent” of a private coalmine company.[101]

Carbon credits

As of 2011, India has become the world's second largest source of carbon credits, or Certified Emission Reductions (CERs), and has attracted foreign companies who trade them to the West. To qualify for saleable credits, companies in "developing" countries must demonstrate their emission reductions go beyond their "business as usual" plans. But according to July 2008 American diplomatic cables released by Wikileaks, most credits certified in India are questionable and do not meet international standards. The cable, written by staff at the United States Consulate in Mumbai, quote a senior Indian carbon credit assessor admitting no projects in India meet the international benchmark. R K Sethi, head of India's Clean Development Mechanism Authority, admitted his colleagues simply take "the project developer at his word" when they approve carbon credit applications. Eva Filzmoser of CDM Watch, which campaigns for a more rigorous carbon credit system, said the cable effectively dismissed Indian schemes as "a source of extra revenue for projects that would have happened anyway." Thirty-three coal power plants were among 1700 carbon credit project bids in India, and four of the power stations are among 700 projects approved to date.[102]A 2011 Stockholm Environment Institute report found that project documents for Indian Clean Development Mechanism projects "inflate the benefits of switching from subcritical to supercritical technology. Specifications of technologies currently available in the market suggest the relative efficiency and emissions improvements are likely to be on the order of 2 to 4%. In contrast, these coal projects are claiming improvements on the order of at least 11%, on average."[103]

Coal India to use GPS to stop pilferage

It was announced in November 2011 that Coal India would use satellite technology to prevent shipments from being hijacked amid a shortage that has hit supplies to thermal power projects in the country. It is estimated that at least a quarter of 431 million tonnes of coal was stolen in transit.[104]Citizens Groups Tracking Coal Power and Mining in India

- Conservation Action Trust

- Environmental Protection Group, Orissa

- India Youth Climate Network

- Jharkhand Mines Area Coordination Committee

- Kalpavriksh Environment Action Group

- Kuntala Lahiri Dutta Australia

- Mines, Minerals and People

- Samata

Government Agencies

Notes

- Jump up ↑ "Power Sector at a Glance" CEA, accessed Oct. 2011.

- Jump up ↑ Ananth P. Chikkatur, "A Resource and Technology Assessment of Coal Utilization in India," Coal Initiative Reports White Paper Series, Pew Center on Global Climate Change, October 2008

- Jump up ↑ "India: Quick Facts" EIA, August 2010.

- Jump up ↑ "Growth of installed capacity since 6th Plan," Central Electricity Authority, accessed June 2012

- Jump up ↑ The figure for current capacity as of May 31, 2012 comes from Table 2, "Summary statistics for proposed coal plants in India," which is derived from the complete table shown in Proposed coal plants in India

- Jump up ↑ Using data from the Ministry of Environment and Forest, Prayas found that 192,913 MW of coal and gas capacity had received environmental clearance, with another 508,907 MW in the pipeline and expected to be approved, for a total of 701,820 MW. Of this total, Prayas estimated that coal accounts for 84%, or 589,529 MW. See "Thermal Power Plants on the Anvil," Prayas Energy Group, August 2011.

- Jump up ↑ For plant-by-plant information, see Proposed coal plants in India.

- Jump up ↑ "Ultra Mega Power Projects," Ministry of Power, accessed July 2012

- Jump up ↑ Amiti Sen & Subhash Narayan, "States make case for second UMPP with advanced land clearances", Economic Times, (India), March 20, 2010.

- ↑ Jump up to: 10.0 10.1 Ultra Mega Power Projects, Ministry of Power Government of India, undated but approx October 2007.

- Jump up ↑ "Coal Fired Plants Financed by International Public Investment Institutions since 1994", Appendix A in Foreclosing the Future: Coal, Climate and International Public Finance: Investment in coal-fired power plants hinders the fight against global warming, Environmental Defense, April 2009.

- ↑ Jump up to: 12.0 12.1 "India", World Coal Institute, undated, accessed June 2008.

- Jump up ↑ "China coal imports to double in 2015, India close behind" Rebekah Kebede, Reuters, May 30, 2011.

- Jump up ↑ "Indian coal rush heads Australia's way" Ben Doherty, Sydney Morning Herald, October 6, 2011.

- Jump up ↑ "Coal India production target likely at 464 MT for FY13" Business Standard, January 22, 2012.

- Jump up ↑ "India fails to meet electricity targets" United Press International, January 24, 2012.

- Jump up ↑ Pratim Ranjan Bose, "Poor rail connectivity hampers potential coal output", The Hindu Business Line, January 19, 2012.

- Jump up ↑ "15 Coal India mines may get conditional green ministry nod" Raj Kumar Sahu, NDTV, July 30, 2012.

- Jump up ↑ "India said to lose $210b in coal deals," AP, March 23, 2012.

- Jump up ↑ "India's coal reserves to run out in 45 years news," domain-b.com, December 26, 2009.

- Jump up ↑ "India: Quick Facts" EIA, August 2010.

- Jump up ↑ Atrayee Lahiri, "28 coal block limits to be redefined to boost supply" Mydigitalfc, May 16, 2011.

- Jump up ↑ "Coal blocks: Ramesh says border line cases should get cleared" MSN, June 24, 2011.

- Jump up ↑ "India", World Coal Institute, undated, accessed June 2008.

- Jump up ↑ "India’s SCCL stars $190m Adriyala coal mine" Miners Weekly, july 1, 2011.

- Jump up ↑ U.S. Geological Survey, "Table 2 India: Structure of the Mineral Industry in 2006", in 2006 Minerals Yearbook, U.S. Geological Survey, March 2008, pages 10.11 - 10.12.

- Jump up ↑ "India's child coal miners" The Christian Science Monitor, Sep. 20, 2010.

- Jump up ↑ Mark Magnier, "In northeast India coal towns, many miners are children" LA Times, May 15, 2011.

- Jump up ↑ "Great Eastern Energy in pact with TN for gas block development" Business Standard, January 4, 2011.

- Jump up ↑ "342 killed in PSU mines in four years" The Sunday Guardian January 8, 2012.

- Jump up ↑ [1] Los Angeles Times May 15, 2011.