...and I am Sid Harth: Inflation-101 for Dummies

gosumercogito.blogspot.com/.../causes-of-inflation-inflation-means.html

2 hours ago - Causes of Inflation. Inflation means there is a sustained increase in the price level. The main causes of inflation are either excess aggregate ...Causes of Inflation

1. Demand pull inflation

If the economy is at or close to full employment then an increase in AD leads to an increase in the price level. As firms reach full capacity, they respond by putting up prices, leading to inflation. Also, near full employment, workers can get higher wages which increases their spending power.

We tend to get demand pull inflation, if economic growth is above the long run trend rate of growth. The long run trend rate of economic growth is the average sustainable rate of growth and is determined by the growth in productivity.

Example of demand pull inflation in the UK

In

the 1980s, the UK experienced rapid economic growth. The government cut

interest rates and also cut taxes. House prices rose by up to 30%

fuelling a positive wealth effect and a rise in consumer confidence.

This increased confidence led to higher spending, lower saving and an

increase in borrowing. However, the rate of economic growth reached 5% a

year – well above the UK’s long run trend rate of 2.5 %. The result was

a rise in inflation as firms could not meet demand. It also led to a

current account deficit. You can read more about this inflation at the Lawson Boom of the 1980s

In

the 1980s, the UK experienced rapid economic growth. The government cut

interest rates and also cut taxes. House prices rose by up to 30%

fuelling a positive wealth effect and a rise in consumer confidence.

This increased confidence led to higher spending, lower saving and an

increase in borrowing. However, the rate of economic growth reached 5% a

year – well above the UK’s long run trend rate of 2.5 %. The result was

a rise in inflation as firms could not meet demand. It also led to a

current account deficit. You can read more about this inflation at the Lawson Boom of the 1980s2. Cost Push Inflation

If there is an increase in the costs of firms, then firms will pass this on to consumers. There will be a shift to the left in the AS.

1. Rising wages

If trades unions can present a common front then they can bargain for higher wages. Rising wages are a key cause of cost push inflation because wages are the most significant cost for many firms. (higher wages may also contribute to rising demand)

2. Import prices

One third of all goods are imported in the UK. If there is a devaluation then import prices will become more expensive leading to an increase in inflation. A devaluation / depreciation means the Pound is worth less, therefore we have to pay more to buy the same imported goods.

In 2011/12, the UK experienced a rise in cost-push inflation, partly due to the depreciation in the Pound against the Euro. (also due to higher taxes)

3. Raw Material Prices

The best example is the price of oil, if the oil price increase by 20% then this will have a significant impact on most goods in the economy and this will lead to cost push inflation. E.g. in early 2008, there was a spike in the price of oil to over $150 causing a temporary rise in inflation.

4. Profit Push Inflation

When firms push up prices to get higher rates of inflation. This is more likely to occur during strong economic growth.

5. Declining productivity

If firms become less productive and allow costs to rise, this invariably leads to higher prices.

6. Higher taxes

If the government put up taxes, such as VAT and Excise duty, this will lead to higher prices, and therefore CPI will increase. However, these tax rises are likely to be one-off increases. There is even a measure of inflation (CPI-CT) which ignores the effect of temporary tax rises/decreases.

What else could cause inflation?

Rising house pricesRising house prices do not directly cause inflation, but they can cause a positive wealth effect and encourage consumer led economic growth. This can indirectly cause demand pull inflation

Printing more money

If the Central Bank prints more money, you would expect to see a rise in inflation. This is because the money supply plays an important role in determining prices. If there is more money chasing the same amount of goods, then prices will rise. Hyperinflation is usually caused by an extreme increase in the money supply

However, in exceptional circumstances – such as liquidity trap / recession, it is possible to increase the money supply without causing inflation. This is because in recession, an increase in the money supply may just be saved, e.g. banks don’t increase lending but just keep more bank reserves.

See: The link between money supply and inflation

Inflation expectations

Once inflation sets in it is difficult to reduce it For example, higher prices will cause workers to demand higher wages causing a wage price spiral. Therefore, expectations of inflation is important. If people expect high inflation, it tends to be self-serving.The attitude of the monetary authorities is important for example if there was an increase in AD and the monetary authorities accommodated this by increasing the money supply then there would be a rise in the price level

Different Types of Inflation

- Demand pull inflation – this occurs when the economy grows quickly and starts to ‘overheat’ – Aggregate demand (AD) will be increasing faster than aggregate supply (LRAS).

- Cost push inflation – this occurs when there is a rise in the price of raw materials, higher taxes, e.t.c

1. Demand Pull Inflation

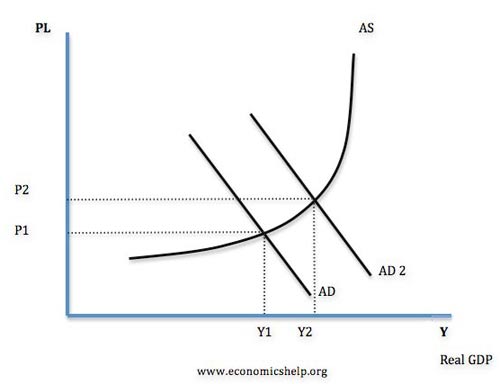

This occurs when AD increases at a faster rate than AS. Demand pull inflation will typically occur when the economy is growing faster than the long run trend rate of growth. If demand exceeds supply, firms will respond by pushing up prices.

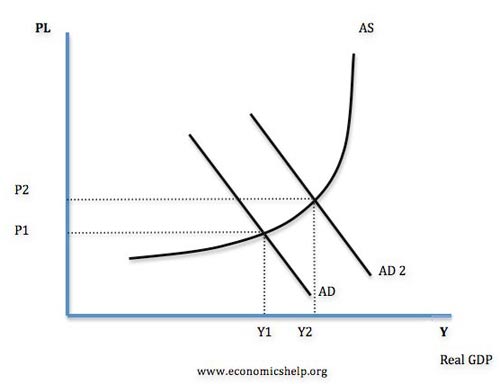

Simple diagram showing demand pull inflation

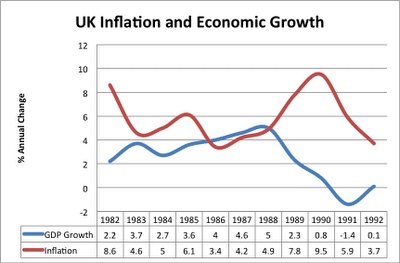

The UK experienced demand pull inflation during the Lawson boom of the late 1980s. Fuelled by rising house prices, high consumer confidence and tax cuts, the economy was growing by 5% a year, but this caused supply bottlenecks and firms responded by increasing prices.

This graph shows inflation and economic growth in the UK during the 1980s. High growth in 1987, 1988 of 4-5% caused an increase in the inflation rate. It was only when the economy went into recession in 1990 and 1991, that we saw a fall in the inflation rate.

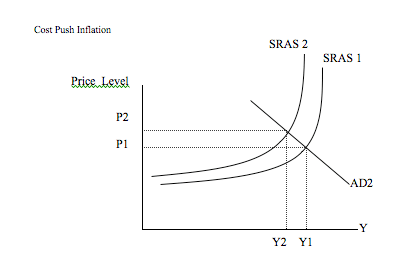

2. Cost Push Inflation

This occurs when there is an increase in the cost of production for firms causing aggregate supply to shift to the left. Cost push inflation could be caused by rising energy and commodity prices. See: Cost Push inflationSimple Diagram showing cost push inflation.

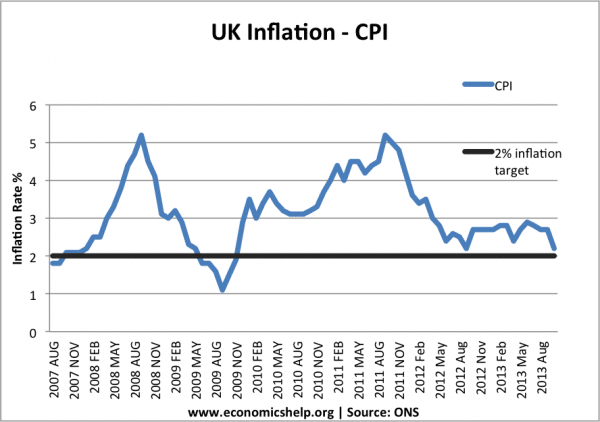

Example of Cost push inflation in the UK

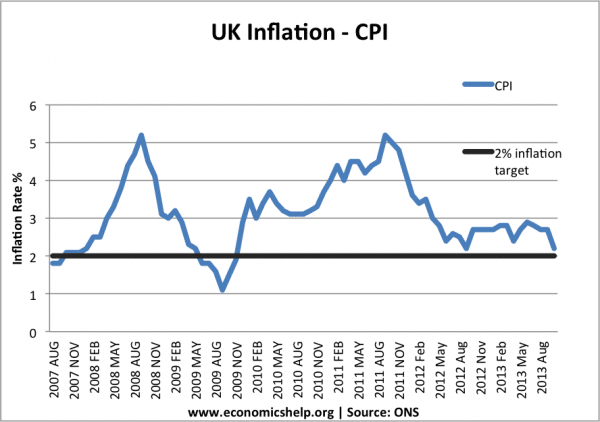

In early 2008, the UK economy entered a deep recession(GDP fell 6%). However, at the same time, we experienced a rise in inflation. This inflation was definitely not due to demand side factors; it was due to cost push factors, such as rising oil prices, rising taxes and rising import prices (as a result of depreciation in the Pound) By 2013, cost push factors had mostly disappeared and inflation had fallen back to its target of 2%.

Sometimes cost push inflation is known as the ‘wrong type of inflation‘ because this inflation is associated with falling living standards. It is hard for the Central Bank to deal with cost push inflation because they face both inflation and falling output.

3. Wage Push Inflation

Rising wages tend to cause inflation. In effect this is a combination of demand pull and cost push inflation. Rising wages increase cost for firms and so these are passed onto consumers in the form of higher prices. Also rising wages give consumers greater disposable income and therefore cause increased consumption and AD. In the 1970s, trades unions were powerful in the UK. This helped cause rising nominal wages; this was a significant factor in causing inflation.

4. Imported Inflation.

A depreciation in the exchange rate will make imports more expensive. Therefore, the prices will increase solely due to this exchange rate effect. A depreciation will also make exports more competitive so will increase demand.

5. Temporary Factors.

The inflation rate can also increase due to temporary factors such as increasing indirect taxes. If you increase VAT rate from 17.5% to 20%, all goods which are VAT applicable will be 2.5% more expensive. However, this price rise will only last a year. It is not a permanent effect.

Core Inflation

One measure of inflation, is known as ‘core inflation‘ This is the inflation rate that excludes temporary ‘volatile’ factors, such as energy and food prices. The graph below shows inflation in the EU. The headline inflation rate (HICP) is more volatile rising to 4% in 2008, and then falling to -0.5% in 2009. However, the core inflation (HCIP – energy, food, alcohol and tobacco) is more constant.

Example of Inflation in UK

This shows that energy prices were very volatile in this period, contributing to cost push inflation in 2008.

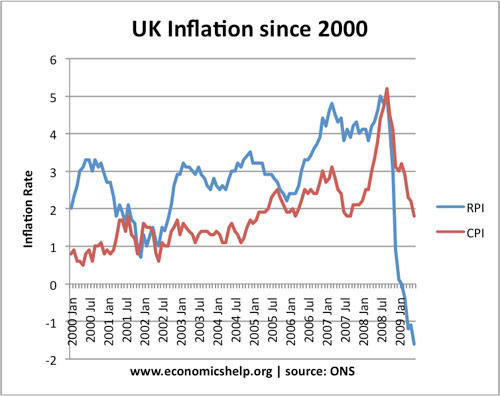

Different measures of inflation

There are different measures of inflation.

RPI includes mortgage interest payments. In 2009, interest rates were

cut, therefore, RPI measure of inflation became negative. CPI excludes

the effect of mortgage interest payments. The ONS now produce a

statistic CPIH, which is CPI – owner occupier costs.

Related

About – Tejvan Pettinger

This blog is written by Tejvan Pettinger. (born 1976)

This blog is written by Tejvan Pettinger. (born 1976)He lives in Oxford where he works as an Economics teacher (A Level students) at Greenes College and formerly with Cherwell College, Oxford. Tejvan Pettinger studied PPE at Lady Margaret Hall, Oxford University, gaining a 2:1.

He contributes articles to the Economic Review and writes regularly on economics.

Between 2001 and 2006 he worked as examiner and Team Leader for Edexcel examinations.

Source: Economicshelpdotorgga.

Jun 6, 2014

Economy & Business

Stop Blaming the Monsoon: Bad Rains Don’t Cause India’s Inflation

- Women danced during a special mass prayer for rain in Jodhpur, Rajasthan, July 27, 2012.

- Agence France-Presse/Getty Images

If the June-through-September monsoon fails to bring enough water to India’s rain-fed fields, goes the millennia-old worry, then a drought will cause production to plummet, farmers will suffer, and prices will soar.

This year there is extra hand-wringing as people worry about the El Niño weather phenomenon which is associated with droughts in India.

While the weather dread is woven deep into India’s DNA, one Indian this week—R. Sivakumar, head of fixed income at of Axis Mutual Fund—said in a report that much of it may be based on myth.

He said a simple review of recent rainfall, agricultural production and inflation figures surprisingly show that: El Niño often doesn’t trigger drought in India; droughts do not lead to lower production; droughts do not lead to inflation.

“India has changed from the 70s,” Mr. Sivakumar told The Wall Street Journal. “We didn’t have much technology back then…That has changed. Our ability to deal with the rain has changed.”

While there is a strong correlation between El Niño years and those with below-average rainfall, the Axis report said the weather phenomenon leads to bad monsoons only about half of the time. In the last 23 years, for example, there have been seven El Niño years but only three of those had droughts.

Thanks to better irrigation and other technology, agricultural output continued to grow in India in the last decade—even during the some of the worst droughts in 2004 and 2009.

“The lower impact of poor monsoon on agriculture recently could be attributed to the larger share of winter crop (mostly irrigated) as compared to summer (mostly rain-fed) as well as better agri-management during poor rainfall years,” the report said.

Meanwhile, the surge in average inflation rates everyone expects after bad rains just doesn’t occur, said Mr. Sivakumar.

“The dismal scientists fail to explain the sharp rise in food prices in the recent past despite record output,” he said in the report. “On the other hand the period from 1999 to 2004—which saw four below-normal monsoons, including three droughts—saw food inflation of only 4% on average.”

While the stress on the hundreds of millions of Indians that depend on agriculture to make a living is undeniable, the impact of a bad monsoon or drought on the broader economy is just not as large as it used to be.

So where are India’s inflation problems coming from? If you want to know where prices are going, look to New Delhi rather than the skies, Mr. Sivakumar said.

The government’s support prices are a much better indicator than rainfall of where food inflation is going. When the government ratchets up the minimum amount of money buyers have to pay for crops, then inflation rises. When it slows down the increases in minimum purchase prices, inflation slows.

According to that indicator inflation—with or without El Niño or a drought—should cool down this year, Mr. Sivakumar said.

Eric Bellman is the deputy bureau chief for The Wall Street Journal in New Delhi. Follow him on Twitter@EricBellmanWSJ

Source: WSJ

...and I am Sid Harth

No comments:

Post a Comment